chandler az sales tax calculator

The Arizona sales tax rate is currently. Total Price is the final amount paid including sales tax.

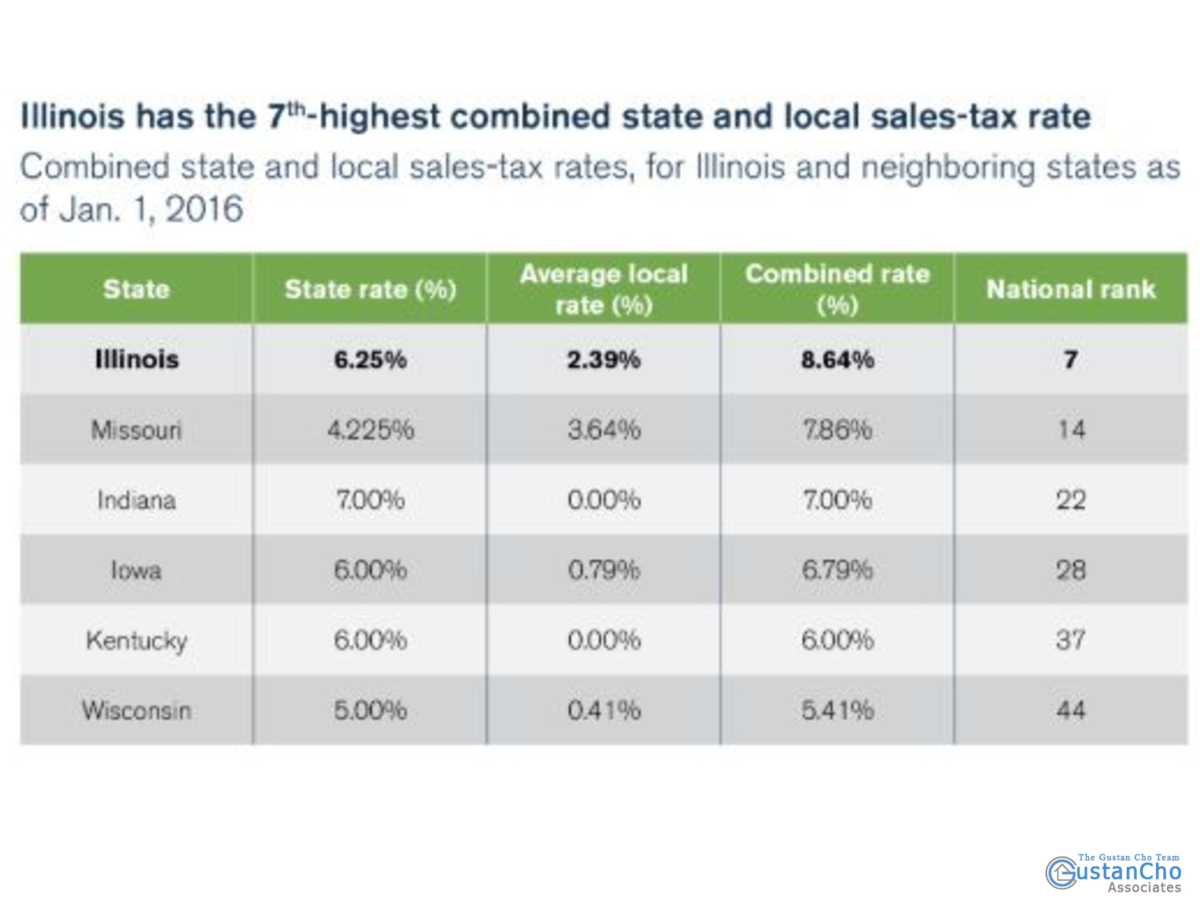

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The minimum combined 2022 sales tax rate for Chandler Arizona is.

. Chandler Arizona and Seattle Washington. Sales Tax Calculator Sales Tax. The County sales tax rate is.

If you choose not to itemize on your Arizona tax return you can claim the Arizona standard deduction which is 12550 for single filers and 25100 for joint filers. Pinal County 72 percent. Chandler AZ Sales Tax Rate.

For State Use and Local Taxes use State and Local Sales Tax Calculator. The Tax License Division administers and issues business registrations and special regulatory licenses. 2022 Cost of Living Calculator for Taxes.

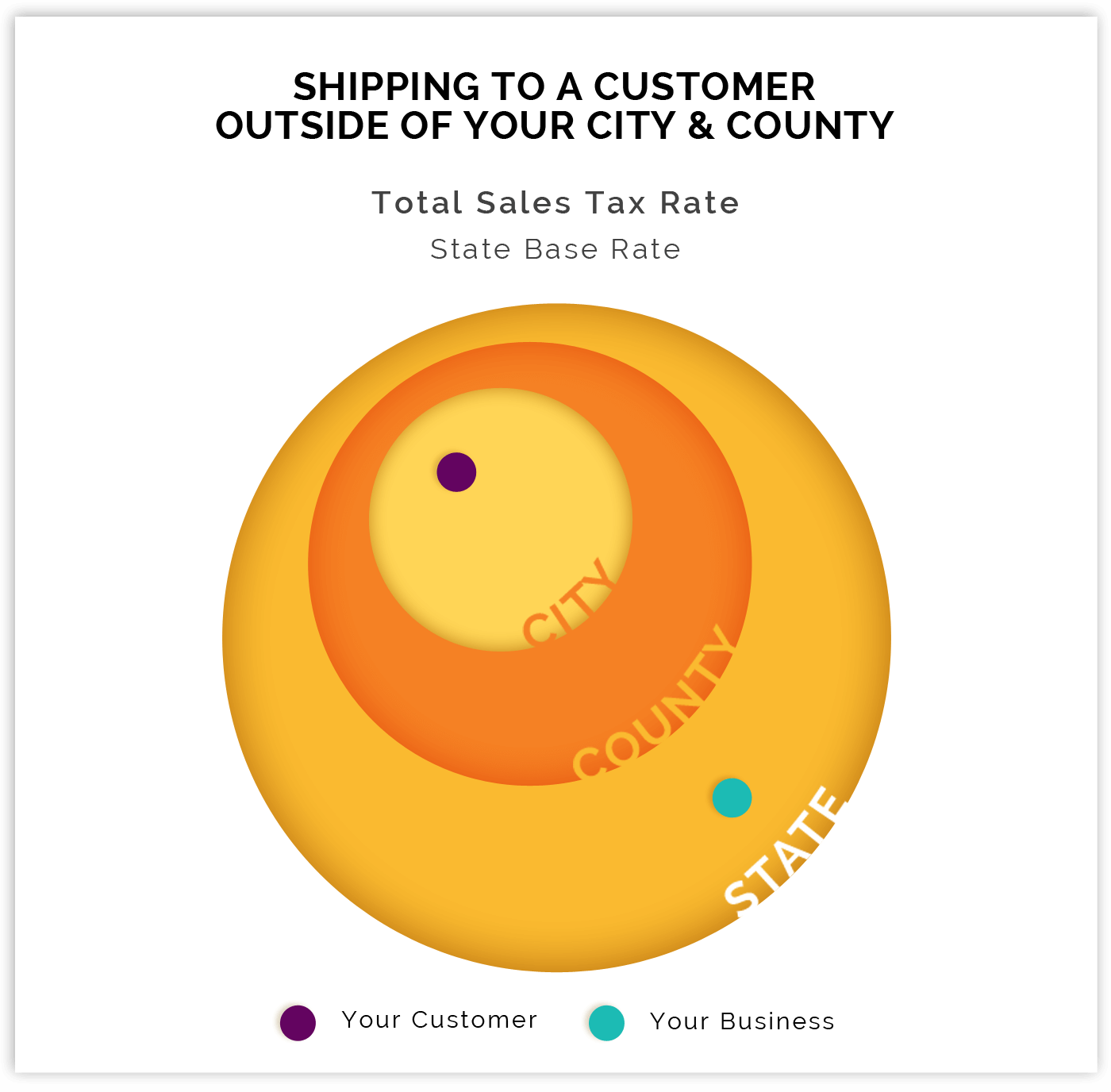

Chandler Arizona and Tulsa Oklahoma. The latest sales tax rates for cities starting with C in Arizona AZ state. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

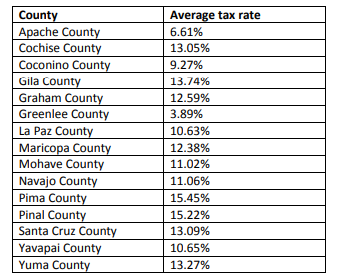

The Chandler Heights sales tax rate is. 2020 rates included for use while preparing your income tax deduction. Apache County 61 percent.

Net Price is the tag price or list price before any sales taxes are applied. The City of Chandler imposes a general tax rate of 15 Restaurant and Bars 18 Utility and Telecommunications 275 and Transient Lodging 29. The County sales tax rate is.

2022 Cost of Living Calculator for Taxes. Wayfair Inc affect Arizona. Each of these match the federal standard deduction.

Washington are 260 more expensive than Chandler Arizona. The statewide rate is 560. When combined with the state rate each county holds the following total sales tax.

You can find more tax rates and allowances for Chandler and Arizona in the 2022 Arizona Tax Tables. Maricopa County 63 percent. Price of Accessories Additions Trade-In Value.

The current total local sales tax rate in Chandler AZ is 7800. Method to calculate West Chandler sales tax in 2021. For more information on vehicle use tax andor how to use the calculator click on the links below.

Did South Dakota v. The Chandler Sales Tax is collected by the merchant on all qualifying sales made within Chandler. Tax Paid Out of State.

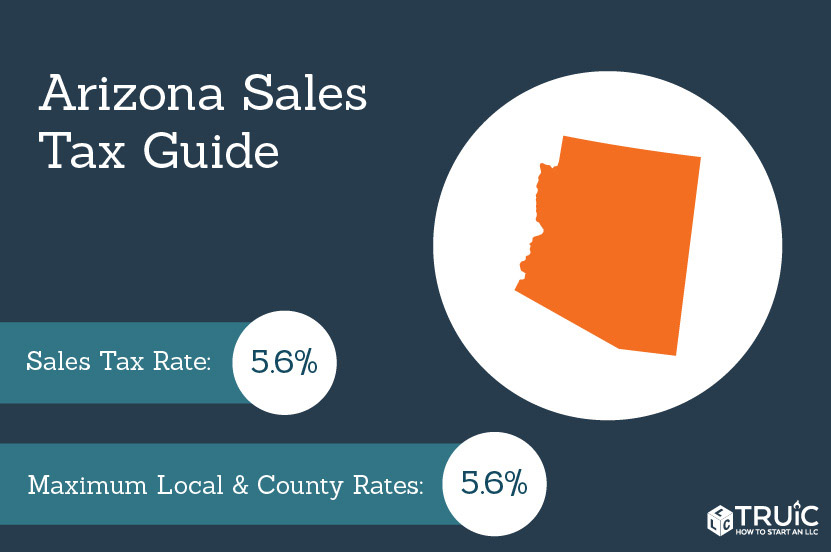

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Youll have to pay state and local sales taxes on purchases made in Arizona.

Link is external Download User Guide. Charco AZ Sales Tax Rate. The Arizona sales tax rate is currently.

Method to calculate Chandler sales tax in 2021. The Chandler Arizona sales tax is 780 consisting of 560 Arizona state sales tax and 220 Chandler local sales taxesThe local sales tax consists of a 070 county sales tax and a 150 city sales tax. Cochise County 61 percent.

- Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Chandler AZ. Greenlee County 61 percent.

Calculate a simple single sales tax and a total based on the entered tax percentage. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. The average sales tax rate in Arizona is 7695.

Groceries are exempt from the Chandler and Arizona state sales taxes. Transaction Privilege Sales Tax. Privilege tax is imposed on the seller for the privilege of doing business in Chandler.

Arizona has a 56 statewide sales tax rate but also has 81 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2433 on top. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Cost of Living Indexes.

The minimum combined 2022 sales tax rate for Chandler Heights Arizona is. Chandler Heights AZ Sales Tax Rate. We continue to work with the Arizona Department of Revenue on the centralized licensing reporting and collecting of transaction privilege sales and use taxes.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Arizona local counties cities and special taxation districts. The Chandler sales tax rate is. Real property tax on median.

The Chandler Arizona sales tax rate of 78 applies to the following eight zip codes. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This is the total of state county and city sales tax rates. Gila County 66 percent. The average sales tax rate in Arizona is 7695.

Sales Tax Calculator Sales Tax Table. The December 2020 total local sales tax rate was also 7800. 85224 85225 85226.

Rates include state county and city taxes. Sales Tax State Local Sales Tax on Food. Chandler in Arizona has a tax rate of 78 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Chandler totaling 22.

As of 2020 the current county sales tax rates range from 025 to 2. SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. All privilege tax revenues are not dedicated and all go directed to the.

This is the total of state county and city sales tax rates.

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

Arizona Sales Tax Small Business Guide Truic

Chandler Arizona Department Of Revenue

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Property Tax Rate Changes In Maricopa County Greater Phoenix Arizona

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Jumbo Mortgages Thomas Gessner Loan Officer With The Bongard Gessner Team At Academy Mortgage Chandler Branch Jumbo Mortgage Finance Loans Jumbo Loans

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Is Food Taxable In Arizona Taxjar

Illinois Ranked As Highest Taxed State In The Nation For Taxpayers

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Arizona Sales Tax Rates By City County 2022

Property Taxes In Arizona Lexology

2021 Arizona Car Sales Tax Calculator Valley Chevy

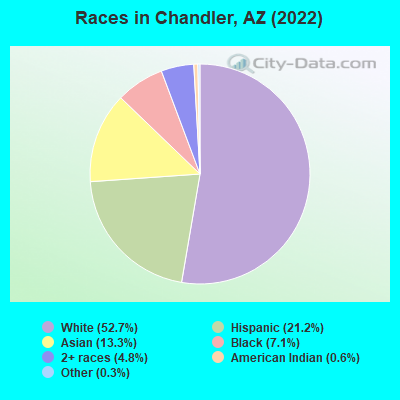

Chandler Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Rental Properties Tax Information City Of Chandler

Arizona Sales Tax Small Business Guide Truic